Employer Wish List for Changes to ACA

Posted: May 19, 2016

Employer “Wish List” for Changes to ACA Continue to Grow & Congress May be Listening

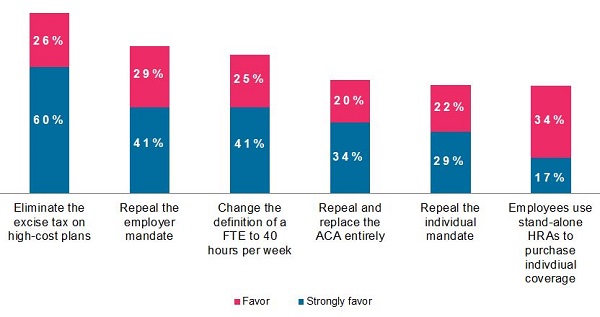

The 6056 reporting requirements needed to administer the employer mandate have undoubtedly led to a costly administrative burden for employers subject to the mandate as an “applicable large employer.” In a recent survey of 644 employers, Mercer asked employers what changes they would like to see made to the Affordable Care Act (ACA). Repealing the excise tax was first, with 85% in favor, but repealing the employer mandate was second, favored by 70%.

Congress has granted the excise tax a one year suspension for 2017 while stakeholders continue to make a case for repeal. Recent legislation introduced and sponsored by Virginia Senator Mark Warner shows that Congress may be listening when it comes to 6056 reporting concerns. Senate Bill 1996 would streamline the employer reporting process and strengthen the eligibility verification process for the premium assistance tax credit and cost-sharing subsidy.

Changes to 6055 & 6056 would include:

- Establishment of a new voluntary reporting system for employers to report to the IRS information about their health plans. Exchanges will use the federal data hub to access this data for individual verification for tax credits.

- Only employees (and/or their dependents) who access subsidized coverage through the exchanges would need to be reported to the IRS, greatly simplifying the requirement of all employees be reported.

- Information that would be reported would include: name and employer identification, who has been extended an offer of minimum essential coverage, whether coverage meets minimum value and the affordability safe harbor, and months that coverage is available without waiting periods.

- Would remove the requirement to collect and report on dependent social security numbers, unless that data is already being collected.

- Would allow employers to deliver reports to employees electronically without another consent form.

- The Government Accountability Office would conduct a study of the notifications, Health and Human Services (HHS) appeals process, and the prospective reporting system.