-

Fire Up the Grill

Posted: June 13, 2017

Summertime is in the air! It’s time for firing up the grill for burgers and dogs!! But before you pullout the charcoal and grilling accessories, take a minute to consider how to cook your meat properly. According to the National Cancer Institute, grilling your meats at high temps can cause potentially cancer-causing chemicals to form […]

-

Happy Companies Make Loyal Employees – Brain versus Brawn; Second in a Series

Posted: June 6, 2017

To begin this discussion, I would like to quote from chapter three of What Happy Companies Know. When modern humanity emerged from the mists of history a few thousand years ago, we were the nerds of the Paleolithic age. Gorillas could kick sand in our face and take our banana money. The major predators could see, […]

-

Happy Healthy Hump Day: It’s Picnic Season – Let’s Talk Food Safety

Posted: May 31, 2017

With Memorial Day behind us, we officially embark on picnic season. The season where food is taken outside and well, let’s be honest, not always prepared and chilled as it should be. My mother would tell you this became my biggest pet peeve after finishing my first year of graduate school. I took a food […]

-

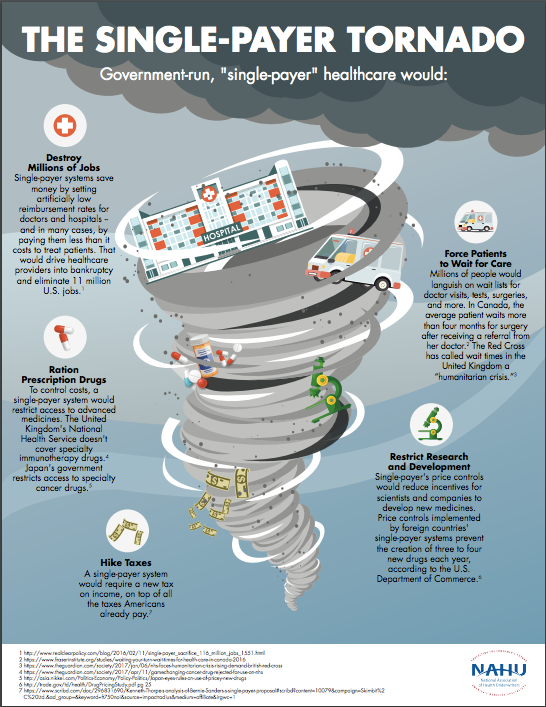

A Problem with the Math: Why Single Payer May Not Ever Be in the Cards

Posted: May 30, 2017

The frustration caused by soaring health care costs and our nation’s difficulty dealing with this increasing crisis is driving some states to consider their own “single-payer” health care system. California is the latest state to consider this move and also the latest to be shocked by the price tag. Colorado, New York, Vermont, and now […]

-

Happy Healthy Hump Day – Impact of Physical Activity on Health

Posted: May 24, 2017

Bobbi here again. We have discussed how nutrition and sleep affect our health. Now let’s add physical activity to the mix. The risk factors seem to be essentially the same across all three. Even I was shocked by these numbers. More than 80% of adults do not meet the guidelines for both aerobic and muscle-strengthening […]