This is Not a Bill

Posted: June 14, 2016

This is Not a Bill: Understanding Your Medical Claims & Reading Your Explanation of Benefits

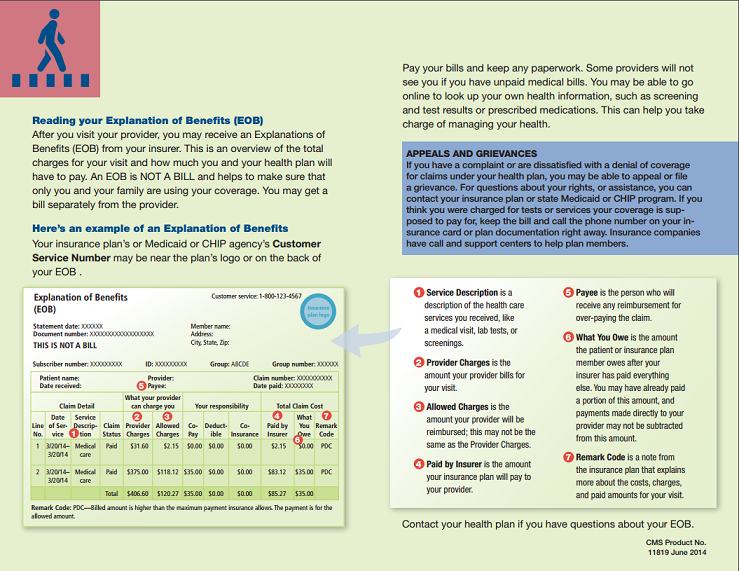

If you are covered by a health insurance plan, you should expect to receive a summary of each healthcare claim approximately 10-14 days following each visit. These summaries are typically referred to as Explanation of Benefits (EOB) or Claim Recaps and will often note at the top of the page that “this is not a bill.” Most plans will also provide access to your EOB’s online.

Why Explanation of Benefits Matter

1.Confirms Your Insurance Company Received the Information

Explanation of Benefits is an important tool for verifying what a provider might be billing you. Failure to receive an EOB for a specific service may indicate that the provider may not have filed the insurance, the information did not trickle down from an originating prover (i.e. from primary care doctor to lab company), or that there may be some other type of data error. Be sure to follow-up with your provider before paying any bill to ensure insurance was filed. Common data errors include misspelling of names and incorrect dates of birth.

2.Confirms Amount You are Billed Matches Insurer Information

Provider bills and EOB’s should be matched-up to confirm provider and insurer agree on YOUR RESPONSIBILITY prior to payment to ensure accuracy. Many providers will not notify you if you overpay due to an error; they will simply credit your account.

3.Identifies Coverage and Provider Errors

If you went in for a Preventive Colonoscopy, but receive a large bill that matches your EOB call your doctor to review. While Preventive care is now typically covered at no charge, it is the physician that determines whether your need is based on an existing health problem or is preventive. If the doctor filed in error as “medically necessary,” he will need to resubmit a corrected claim to your insurer for payment.

4.Allows you to Monitor Coverage and Benefit Accumulations

If your plan features a $5,000 maximum out-of-pocket and your EOB specifies you have reached $4,800, then you’ll know you only have $200 more of cost sharing before coverage for that plan year is 100%.

Likewise, if you have a large claim and see nothing accrued toward your “in-network” balances, you may want to verify the provider you used was in your plan network. Out-of-network claims can have a devastating impact due to possible loss of negotiated pricing, separate deductibles, and, if it’s an HMO, possibly no coverage at all.